- Post-pandemic revenge spending was only a fleeting episode. Weak consumption, downgrading, and deflation are now arriving in succession.

- Capital flight, widening inequality, insufficient social welfare – there are eight deeper structural forces are weighing on China's domestic demand.

- As shrinking consumption pushes firms into price wars, China is exporting deflation abroad, generating new tensions in the global economic system.

"Boosting consumption" has become one of Beijing's most frequently repeated policy priorities. Yet the question remains: How severe is the slowdown in household spending, and how far does its impact reach? A closer examination of the data reveals a story far more structural and far more consequential than a cyclical downturn.

Long-Term Consumption Growth Has Lost Momentum

China's annual growth in total retail sales has slowed markedly. It dropped from 17.1 percent in 2011 to 8 percent in 2019. During the years of strict pandemic controls, consumption expanded by only 2.8 percent annually on average. A brief rebound to 7.2 percent in 2023 quickly faded, with growth falling to 3.5 percent in 2024 and reaching only 4.6 percent in the first eight months of 2025.

Online consumption has also plateaued. E-commerce retail sales growth fell from 33.3 percent in 2015 to 16.5 percent in 2019, and averaged 9.7 percent during the pandemic. In early 2025, online sales grew only 9.6 percent, signaling that China's digital consumption boom has entered a mature and slower phase.

During the pandemic, Chinese e-commerce platforms expanded aggressively abroad. From January 2020 to June 2025, cross-border exports through these platforms totaled 10.3 trillion renminbi, generating a 7.4 trillion surplus. But this surge has raised alarm in Washington and Brussels, where policymakers warn of a new wave of inexpensive Chinese goods undermining local industries and safety standards.

Sector-level data further illustrates the shift. While durable goods spending stabilized post-pandemic, the burst of demand in catering and leisure quickly dissipated. Growth in catering revenue dropped from 20.4 percent in 2023 to 5.3 percent in 2024, and to just 3.6 percent in the first eight months of 2025.

Signs of consumption downgrading are widespread. A 2024 Hakuhodo survey found that 80 percent of Chinese consumers opted for cheaper products and services. The index measuring consumption willingness fell to 67.3, down 9.1 percent from 2019. Luxury consumption also contracted sharply: Bain & Company reported a 20 percent decline in 2024, a drop more severe than during the pandemic.

Imports of foreign consumer goods are shrinking as well. In the first eight months of 2025, overall merchandise imports reached USD 1.7 trillion. After excluding processing-trade equipment and special-zone flows, imports of foreign consumer goods fell 2.4 percent year-on-year, marking eight consecutive months of contraction.

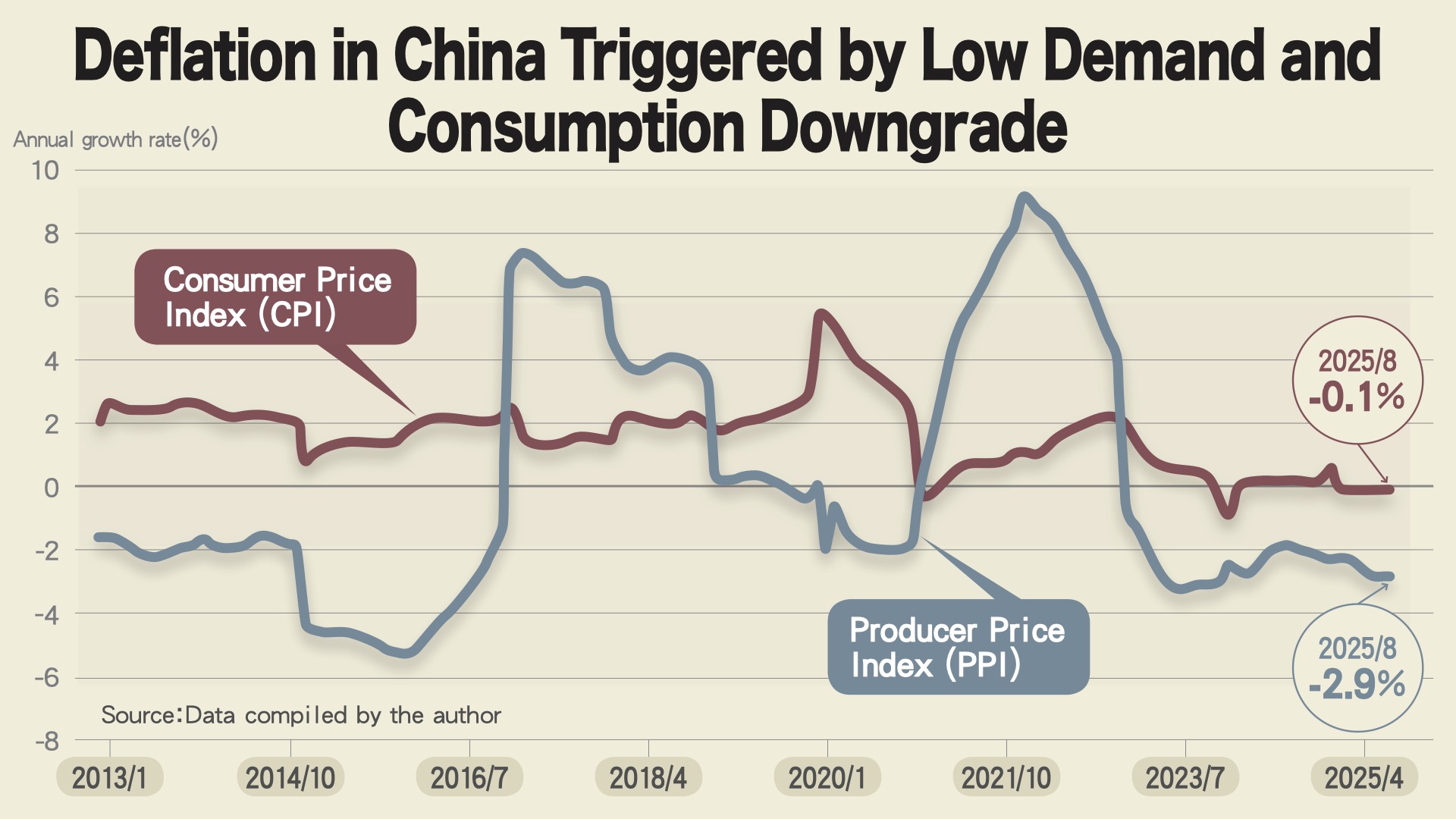

These trends are feeding China's emerging deflation. The Consumer Price Index has remained below 1 percent for 28 consecutive months since May 2023. The Producer Price Index has fallen for 32 straight months. Because PPI historically leads CPI by about six months, weak pricing power is likely to persist.

Eight Structural Forces Behind China's Consumption Slowdown

The consumption downturn is driven by eight interlocking structural challenges: excess capacity, declining investment, weakening confidence, capital flight, a property sector downturn, widening inequality, inadequate social welfare, and demographic decline.

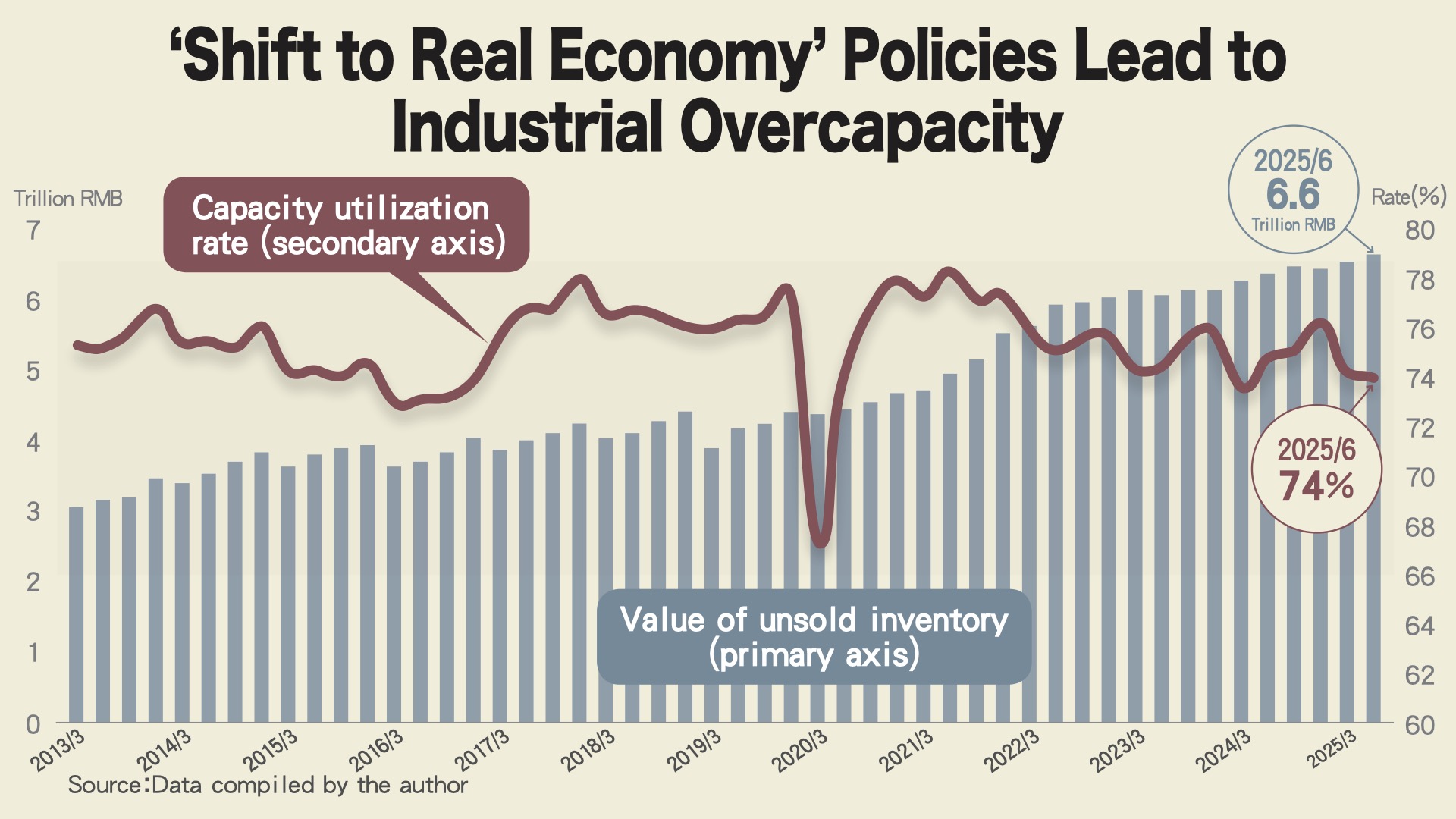

1. Excess Capacity Intensifies Price Competition

China's recent push to channel capital into advanced manufacturing has contributed to broad overcapacity. By mid-2025, the capacity utilization rate for major industrial firms had slipped to 74 percent, below the global risk threshold of 75 percent. Inventories have swelled to 6.6 trillion renminbi, 1.7 times their 2018 level before the U.S.–China trade war. Companies have been forced into steep price competition, further compressing margins.

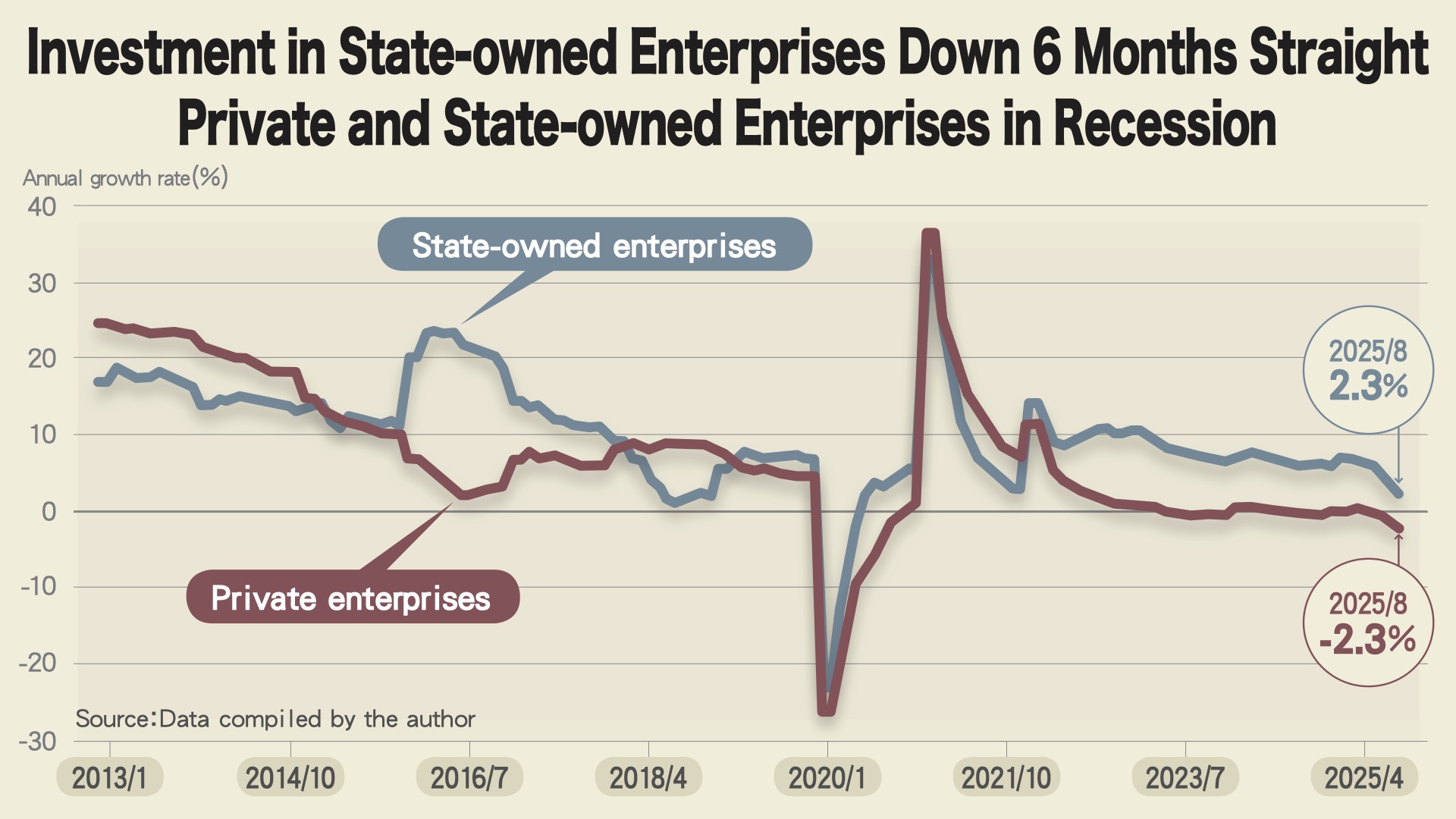

2. A Double Withdrawal: Domestic Retrenchment and Foreign Pullback

Fixed-asset investment has stalled. During the first eight months of 2025, urban fixed-asset investment grew only 0.5 percent, the second-weakest pace since the pandemic. Investment by state-owned enterprises grew by 2.3 percent but has slowed steadily, while private investment has remained below 1 percent growth for 33 consecutive months.

Foreign investment has deteriorated even more sharply. Investigations and compliance crackdowns involving firms such as Bain, Mintz, Capvision, Goldman Sachs, Nomura, and Wells Fargo have fueled capital retreat. Between April 2023 and July 2025, foreign companies are estimated to have withdrawn 10.4 trillion renminbi from China.

3. A Crisis of Confidence: The 26–40 Cohort Leads the Surge in "Lying Flat"

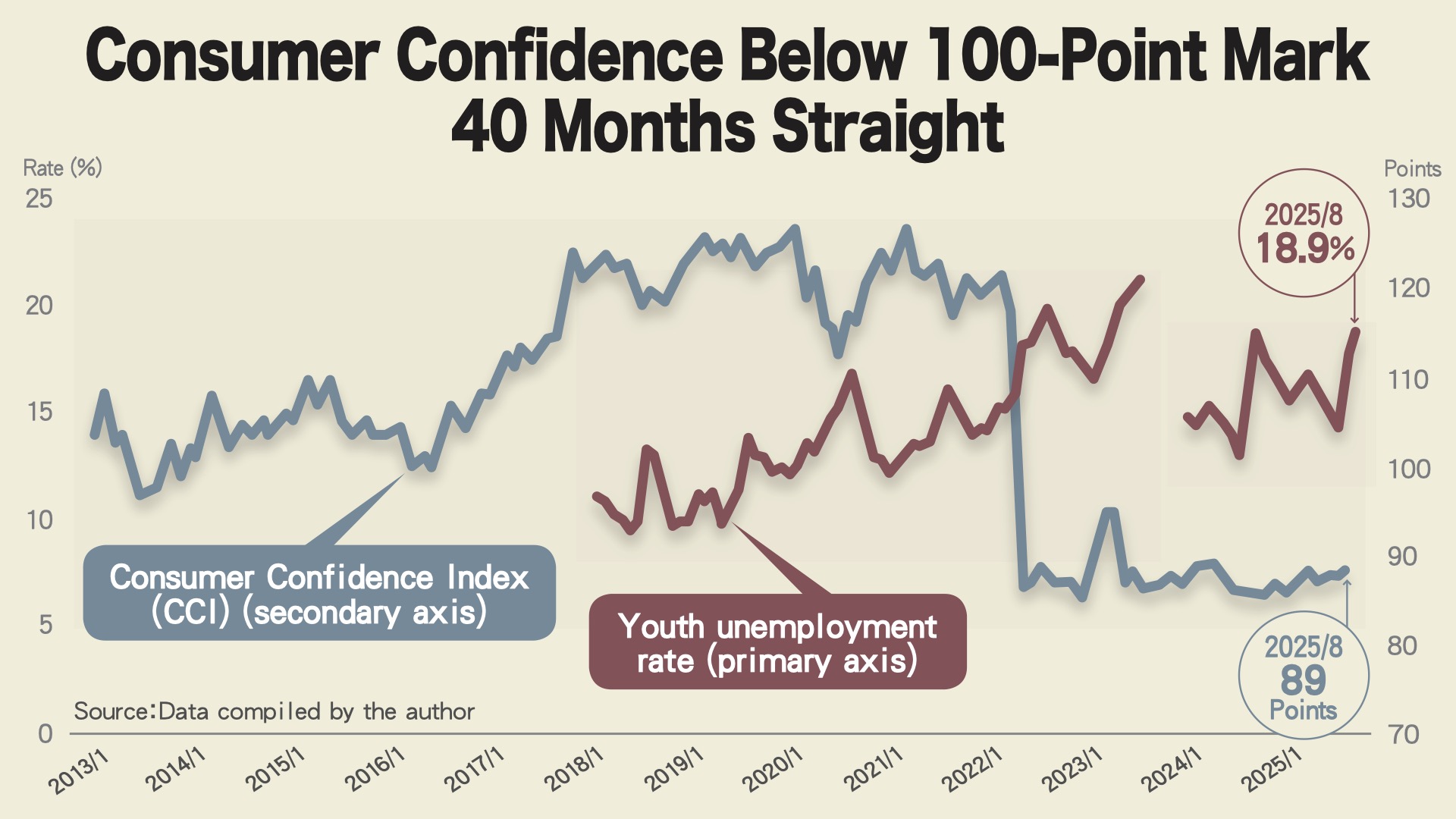

Labor market weakness has weighed heavily on consumer sentiment. Employment indices in the PMI have remained below 50 for 30 straight months. Real wage growth has hovered around 3.9 percent, while youth unemployment remains in double digits.

A 2022 survey found widespread "lying flat" (tang ping) behavior, a quiet withdrawal from economic ambition, especially in major cities and among those aged 26–40. The Consumer Confidence Index has stayed below 100 for 40 consecutive months, averaging 87.8.

4. Capital Flight: People and Wealth Moving Abroad

China has experienced significant outflows of both talent and financial capital. Between 2013 and 2024, net emigration reached 3.96 million. In 2024 alone, 15,200 millionaires emigrated, the most of any country.

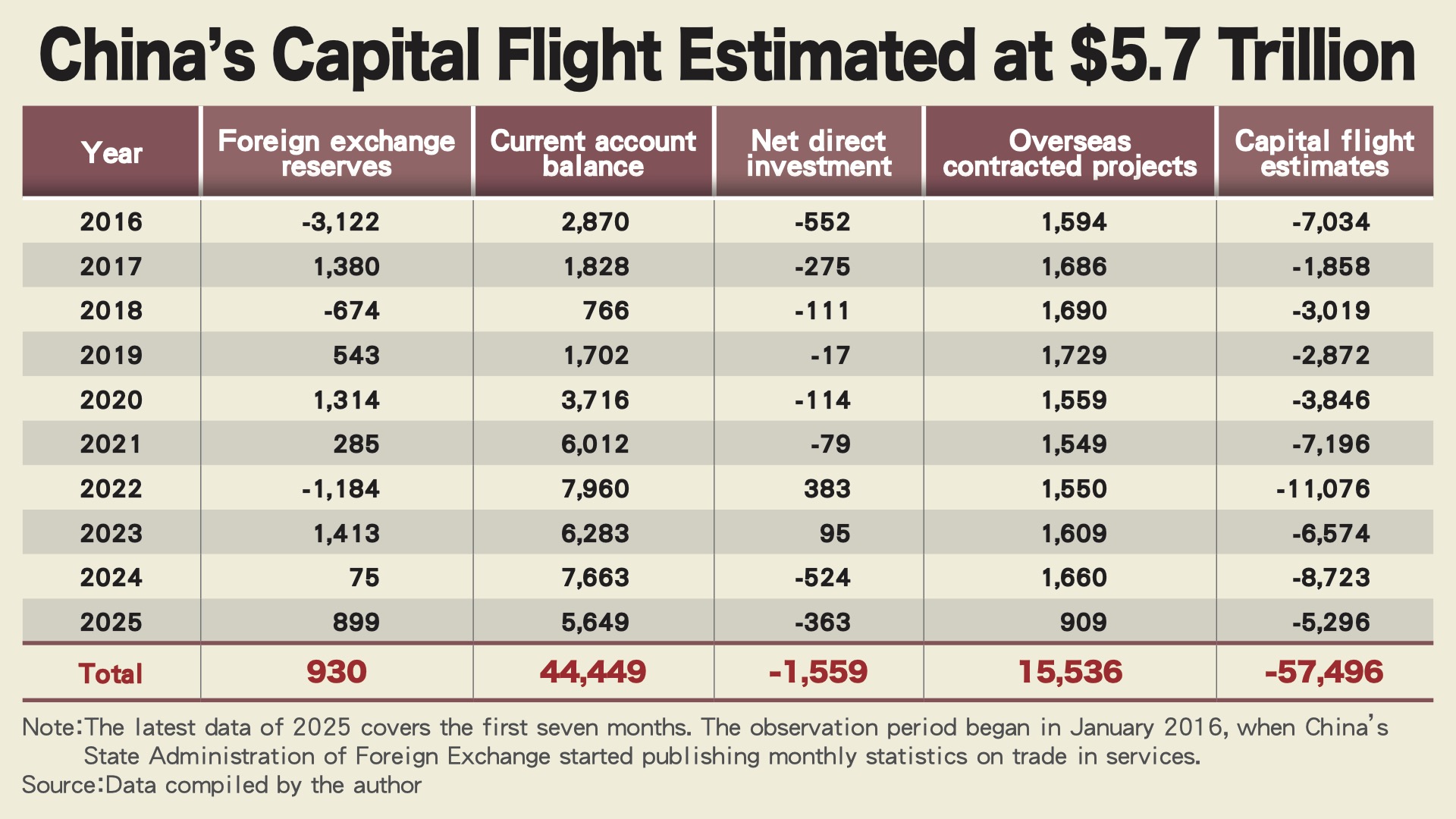

Financial outflows have been even larger. From January 2016 to July 2025, capital flight is estimated at USD 5.7 trillion.

5. Housing Slump Undercuts Consumption, Expands Layoffs

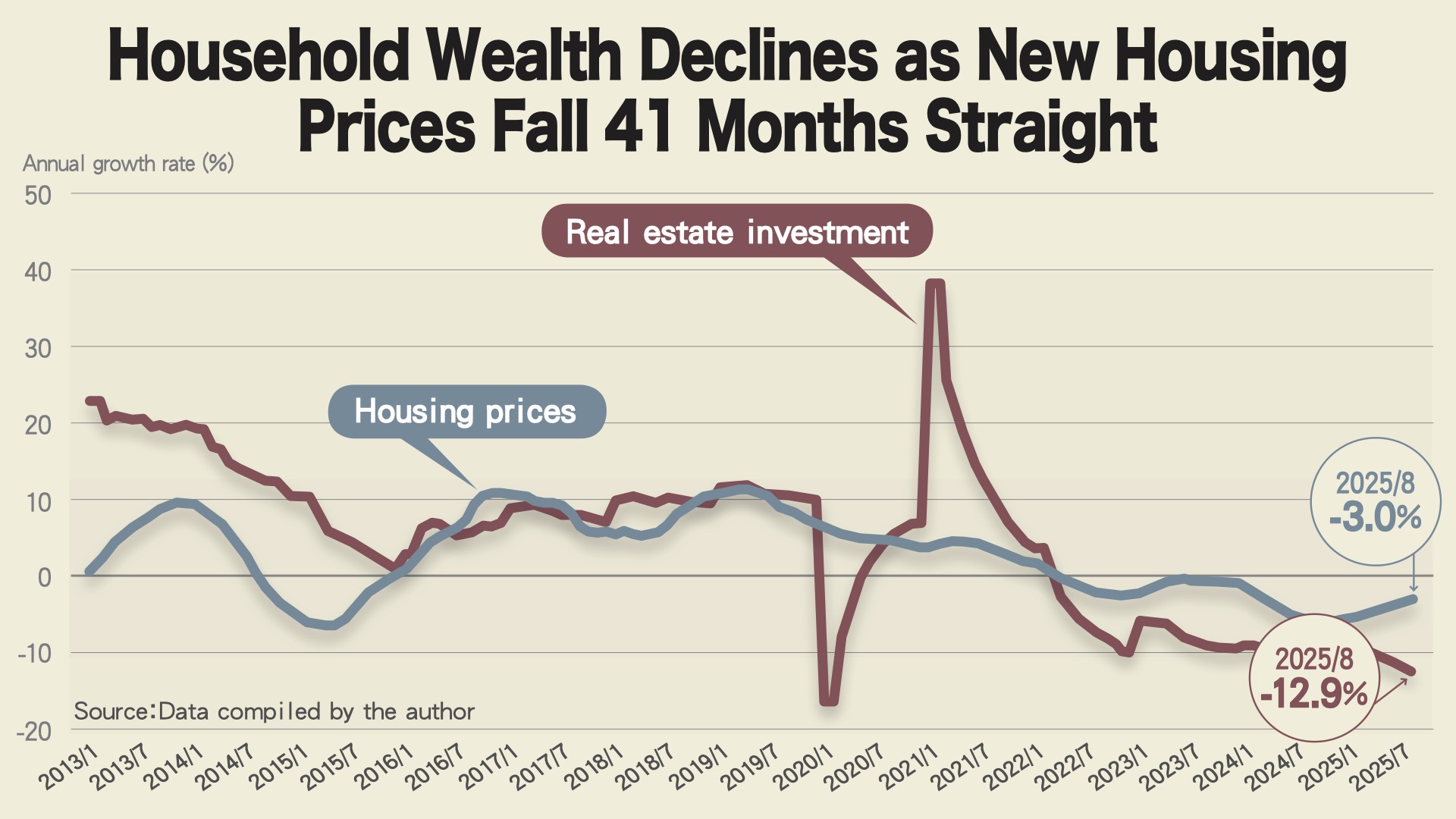

Housing accounts for 59.1 percent of total household wealth in China. The prolonged property downturn has therefore sharply diminished household confidence. Home prices in 70 major cities have fallen for 41 consecutive months, down 10.4 percent from peak levels. China faces an estimated 48 million unfinished homes and 80 million vacant units. Across construction supply chains, 4,794 firms have accumulated overdue payments.

6. Wealth Gap Widens as the Rich Hoard Savings

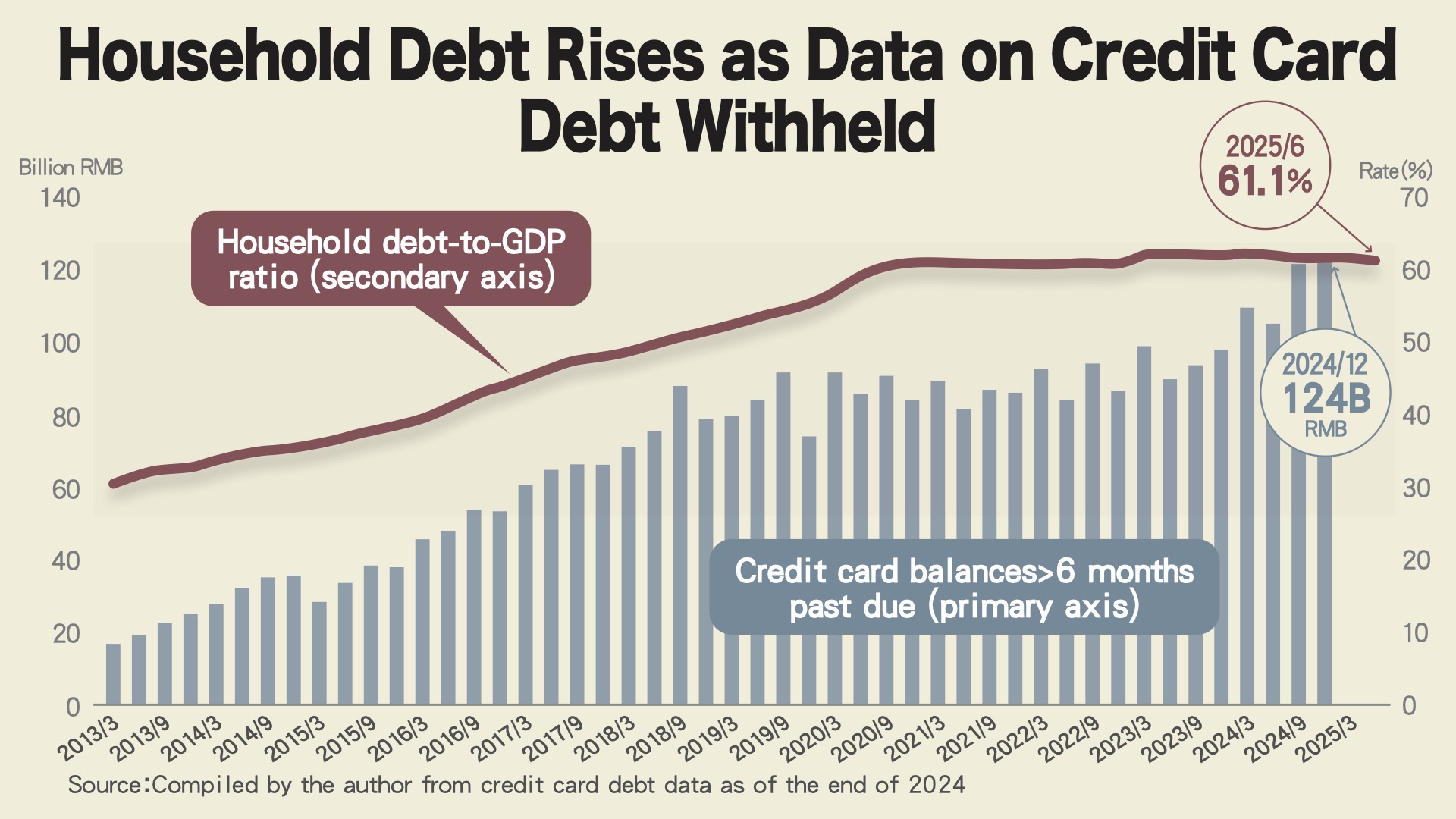

Income inequality has expanded steadily. The gap between average and median income widened from 3,000 renminbi in 2016 to 7,000 in 2024. Income disparity has risen for 40 consecutive quarters. Meanwhile, 81.9 percent of deposits are concentrated in 2.5 percent of households. Lower- and middle-income families face rising debt burdens, including a 26.3 percent surge in credit card delinquencies in 2024.

7. Social Welfare Gaps Create Reluctant Consumers

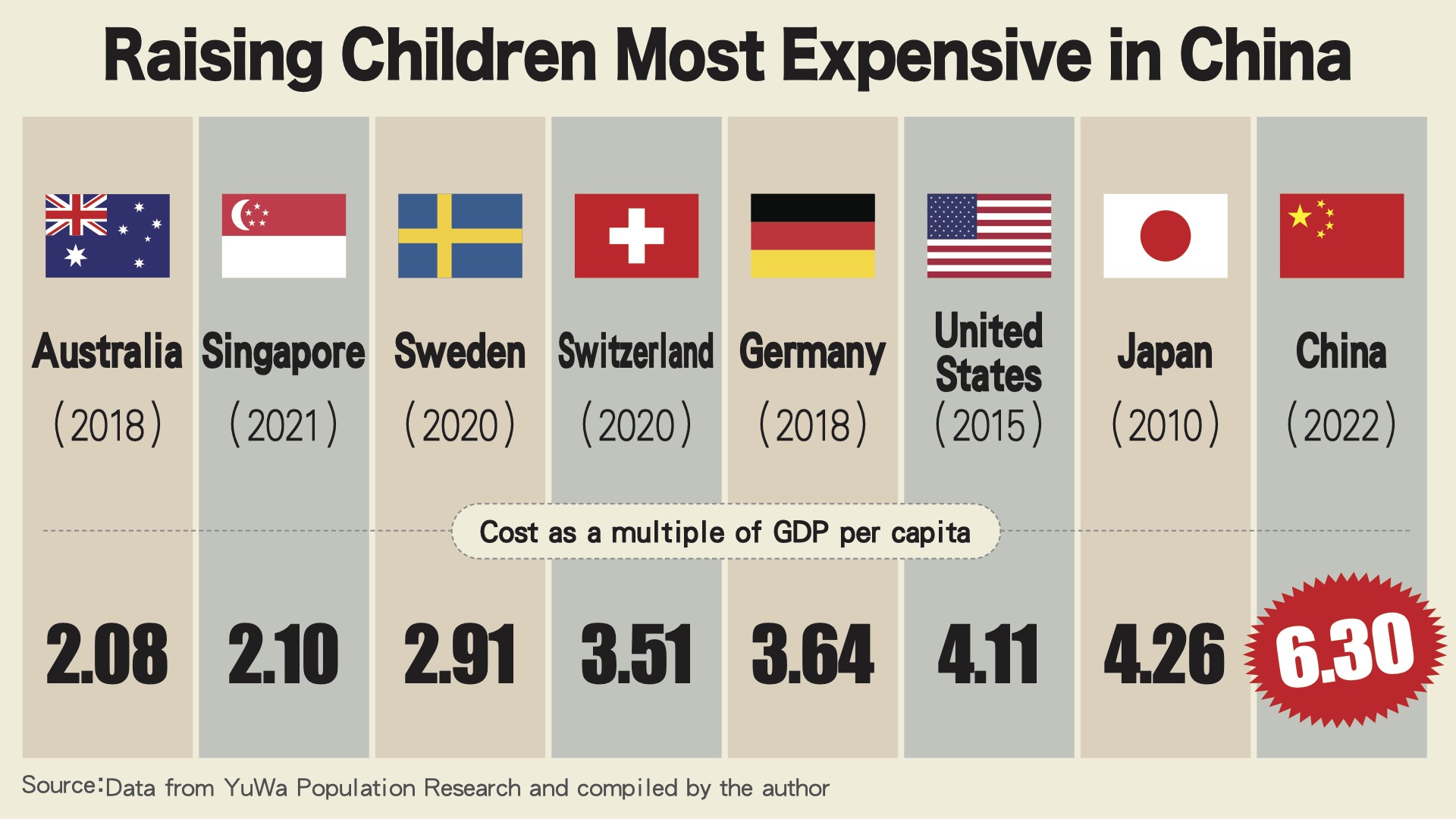

Weak social welfare is a central obstacle to stronger consumption. Housing affordability in Xiamen, Shanghai, and Beijing ranks among the worst in the world. Catastrophic medical spending accounts for 21.7 percent of total medical expenditure, far above global averages. Education costs are strikingly high: raising a child through university costs an estimated 6.3 times GDP per capita, the highest burden worldwide.

8. Aging and Low Fertility Depress Long-Term Demand

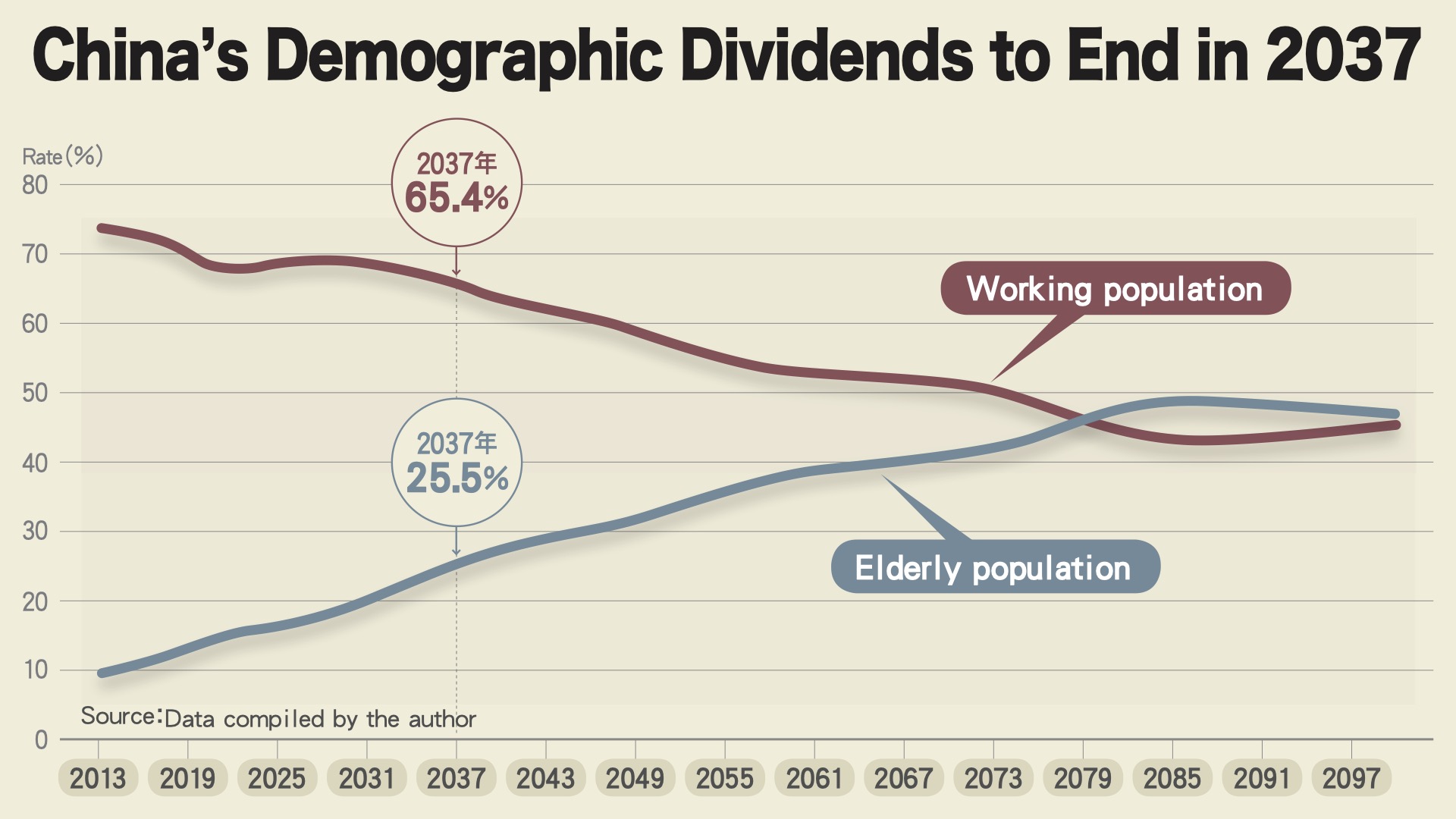

China's demographic headwinds are intensifying. The fertility rate has fallen to 1.24, placing the country in the "ultra-low" range. The working-age population has been shrinking since 2015. By 2031, China is expected to become a super-aged society, with more than 20 percent of its population over 65. Pension funds may face insolvency by 2035. Elderly households, whose savings rate exceeds 60 percent, tend to consume far less.

Policy Measures Struggle to Gain Traction

Beijing has implemented significant fiscal stimulus: 15 trillion renminbi in tax and fee reductions and 26.3 trillion in special bonds from 2020 to 2025. The fiscal deficit ratio has reached 4 percent of GDP. But local government finances remain strained. Land-sale revenue continues to fall, and including local government financing vehicles, total public debt has tripled since 2018 to reach 100.6 trillion renminbi.

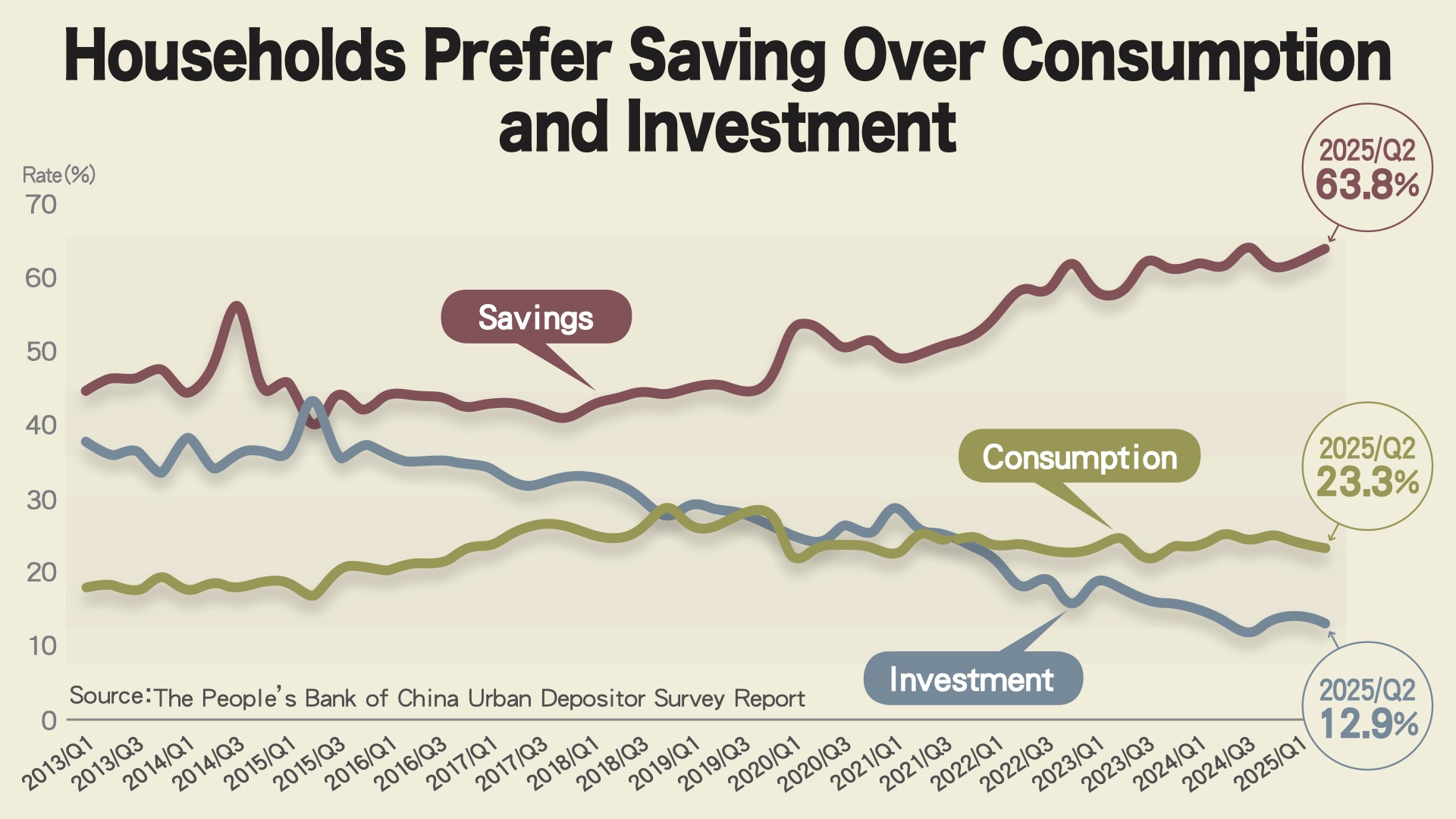

China now appears caught in a liquidity trap. Nearly 63.8 percent of households are increasing savings, while willingness to invest is at historic lows.

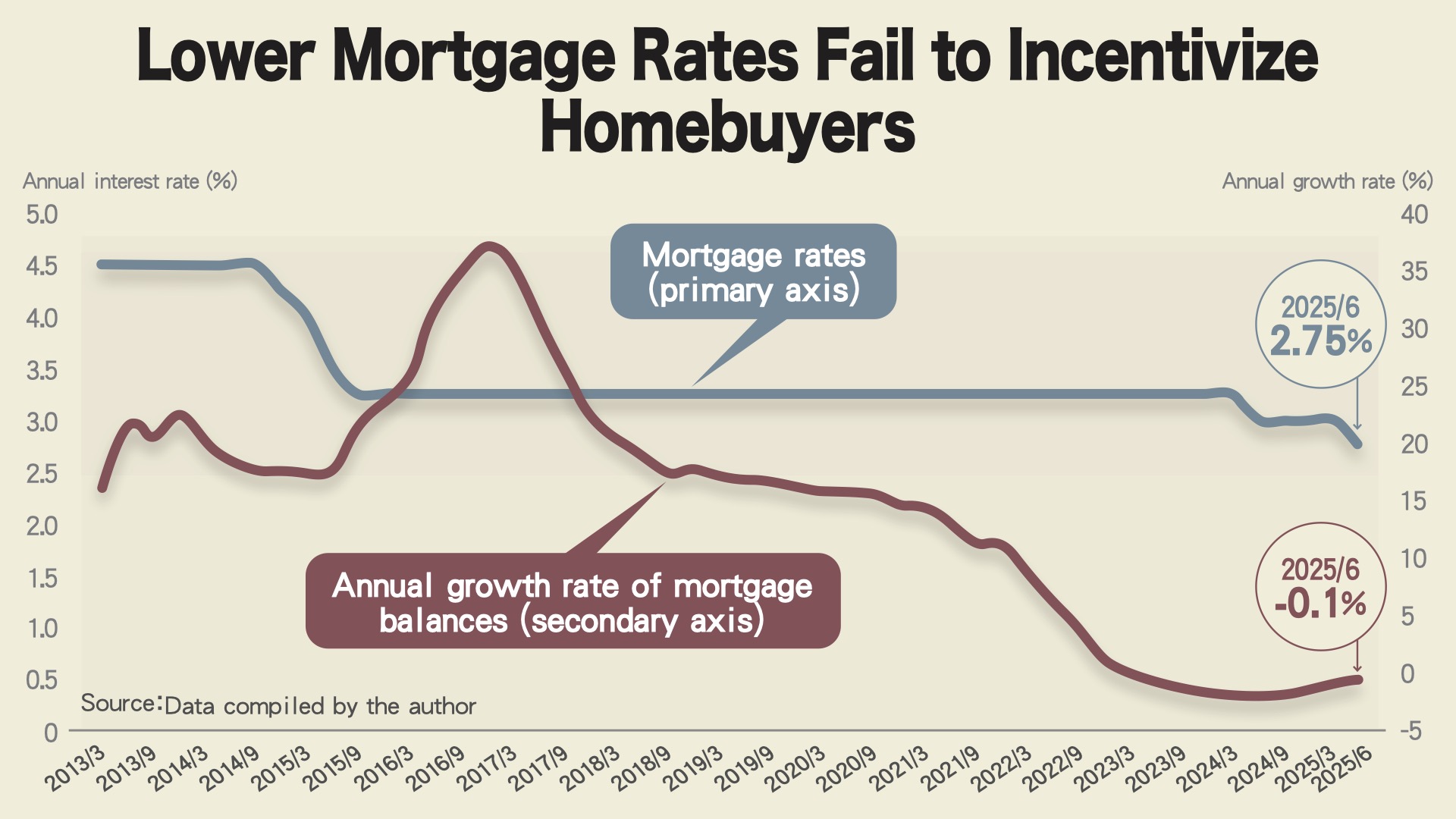

Mortgage rate cuts have not revived demand. Instead, they have triggered widespread prepayments, causing outstanding mortgage balances to fall for nine consecutive quarters, deepening the ongoing balance-sheet recession.

Avoid the Paradox of Thrift and a Downward Spiral

China faces a dangerous feedback loop: shrinking consumption leads to excess capacity; excess capacity suppresses investment; and weak investment reinforces deflation. Without significant structural reforms, this cycle could become self-reinforcing.

The root causes are systemic: an overemphasis on manufacturing, tightening political controls, weak social welfare foundations, and exchange rate constraints that limit monetary policy flexibility.

These domestic challenges have global implications. As Chinese firms discount aggressively to sustain production, they are exporting deflation - a "China Shock 2.0." Between January and August 2025, 158 trade remedy cases were filed against Chinese exports, underscoring rising international backlash.

China's consumption slowdown is no longer a cyclical fluctuation. It is structural, long-term, and increasingly a global problem.

(Translated by Ketty W. Chen and Nicole Wong)